Where did all the money go — swallowed by Jupiter–Pluto conjunction

Each successive Jupiter–Pluto conjunction challenges world economies and makes us think: what is money? Should money be gold, “fiat” paper bills or brand new cryptocurrencies? This dilemma is perfectly expressed by Jupiter’s investment expansiveness that is opposed by the counteracting force of Pluto’s wealth accumulation.

Times of crisis nearly always produce economic hardship due to the magic disappearance of money for common folk like us: our jobs get lost, our pockets get emptied, possessions and savings devalued.

This mysteriously unstable nature of money has puzzled many people. Economists, politicians, bankers, investors and ordinary curious blog writers like myself have all pondered upon what makes money work and what makes money fail?

In this article we are going to look at the notion of money from an astrological standpoint, specifically focusing on the great Jupiter–Pluto polarising force that, apart from numerous other things, is responsible for wealth creation, attraction and redistribution.

We shall see how the first two major economic breakdowns of the 21st century:

- the Global Financial Crisis of 2007–2008; and

- the Great Shutdown (the coronavirus recession) of 2020–2021–…

both unsurprisingly coincided with Jupiter–Pluto conjunctions and induced major stress testing of economic resilience on all countries and their citizens.

Before taking a deeper look into the astrologic nature of economic crises, let’s focus on the topic of the nature of money.

Money is Gold

History of humanity runs deep, its written records stretch up to 6,000 years back in time. We do know that gold and its value were already mentioned in records from about 5,000 years ago.

Throughout the history gold was used as a measurement and a regulator for value of goods due to its scarcity and unique physical properties. Gold has always been seen as metal of the Sun and the ancients often treated gold as a sacred substance.

According to the esoteric knowledge, development of the world trade and exchange is governed by the Sun principle of illumination and reaching out from the core to the furthest periphery. Thus money is the principle of the Sun physically embodied on Earth by the metal of gold.

As it happens with all powerful substances perceived from the position of greed and power, the influence of gold’s potential corrupts its bearer. So far all known empires that were built on the premises of accumulation and domination ultimately failed due to ensuing overreach and corruption.

Money is Promise

Industrial economies and the economic model of capitalism are relatively new systems that have their own share of successes and breakdowns. Capitalist economic system heavily depends on availability of money, aka the capital.

To remain successful capitalism needs endless expansion, which exposes its core problem: a “sustainable expansion” is easier said than done. Money and free markets are like blood and veins for ever expanding capitalist markets. This alone means that gold isn’t a reliable money material since gold resources are limited and scarce.

A simplified version of why did this happen is as follows. After WW2 America committed to peg its dollar value to gold. Initially it was beneficial for other trading countries as they imported a lot of goods from the US. Yet over time other countries began producing their own goods and American exports shrank. Add to that Vietnam war, inflation and public debt. As the result, America “cancelled” out of its promises.

Thus the modern notion of money lost its underlying “value” and ultimately became a “promise” to deliver goods or services. Since money became an instrument of borrowing from the future, an unmanageble Everest-sized mountain of debt has emerged that nobody seems to know how to deal with.

How Jupiter and Pluto cycles influence economy of growth

Now turning our gaze to the classical Greek mythology. Jupiter is the Roman version of Zeus, the alpha-god who became the victorious King of the gods after defeating the Titans with essential help from his brothers, Poseidon (Neptune) and Pluto.

Consequently the celestial world has been divided into three spheres of influence: Zeus became the ruler of the sky, Neptune’s domain are the oceanic expanse and Pluto received the underworlds, a domain referred as Hades, full of immense treasures. The three brothers symbolise three foundational types of power and influence.

While Jupiter naturally rules over forces of expansion and accepts no limits, Pluto acts as a force of accumulation that stores immense riches in its underground domain. It is easier to think of Jupiter as the orchestrator while Pluto is the aggregator. In ancient Greek the name Plouton stands for “giver of wealth”.

The post World War 2 economic miracle was shaped by American affinity with Jupiterian values of optimistic expansion. Yet long-term pursue of the model of unlimited growth is hardly a viable strategy here on Earth with its inherently limited resource pool.

As soon as further expansion becomes unsustainable, Pluto takes stage as a counteracting principle. Pluto is the ultimate hoarder, the black hole that enriches itself by sucking in wealth and possessions. It is a natural and universal principle that acts by removing old systems so that new sprouts can bring the balance back in a new form that isn’t corrupted by past mistakes.

Jupiter–Pluto cosmic couple is perfectly designed for keeping expansion viable through necessary introduction of periodic collapses. Nothing personal here!

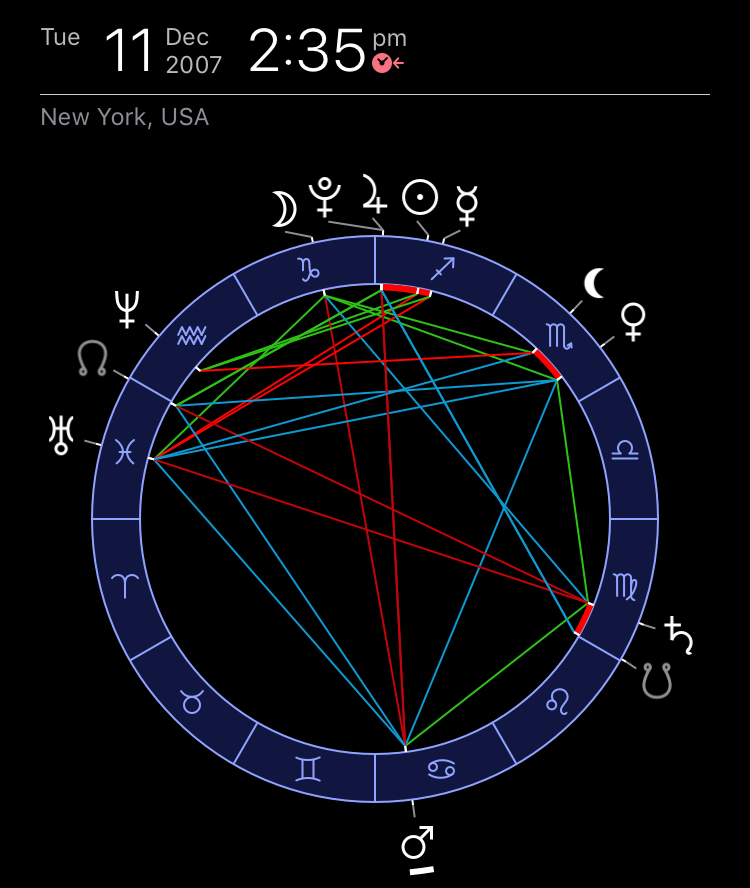

The Great Financial Crisis of 2007-2008

The first tangible shock that impacted the Everest-sized debt pile was the Great Financial Crisis that unfolded during 2007–2008. The crisis was a consequence of unchecked and irresponsible expansion of financial markets into the real estate domain.

It could well be the first direct consequence of money becoming “abstract” ie. detached from real world values as a direct result of decoupling from the gold standard. The lack of limiting influence of gold stimulated blindness and greed of financial institutions that began to see money as purely numbers game with sole purpose is to generate more money.

Corresponding Jupiter–Pluto conjunction developed itself through the second half of 2007 and was relatively short-lived in astrological terms, yet its effects were profound and did hurt a lot of people.

- Began 18 Oct, 2007

- Exact 11 Dec, 2007

- Finished 1 Feb, 2008

If one thinks that the 2008 GFC was a hard one, just wait for the unfoldment of events triggered by the 2020 Jupiter–Pluto conjunction.

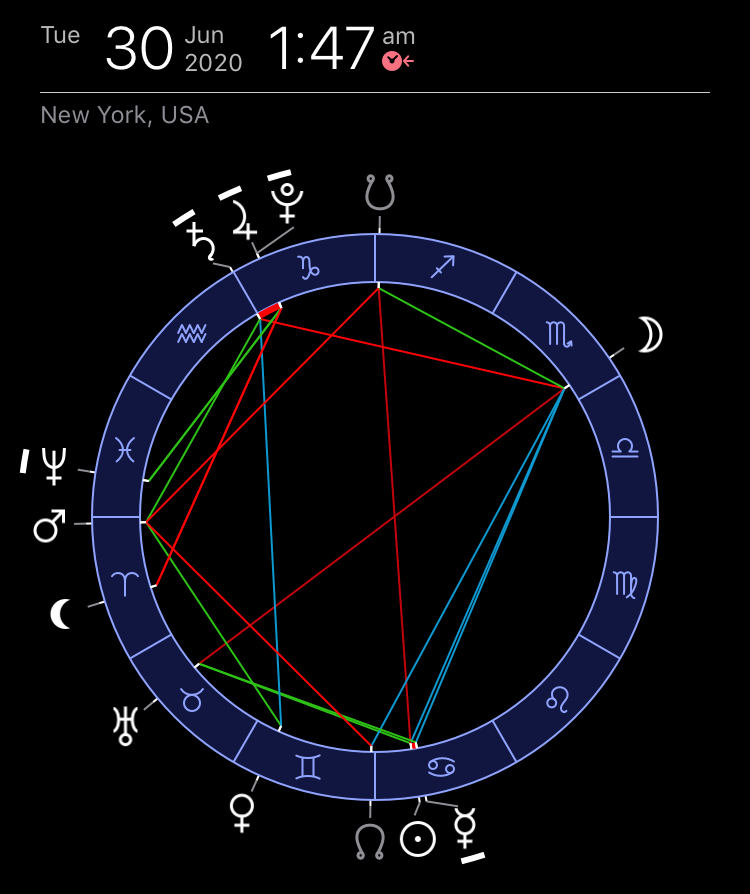

The Even Greater Financial Crisis of 2020s

By comparing astrological charts of 2007 and 2020, it becomes very clear that the GFC of 2008 was a mere “preview” of things to follow during the years of 2020 and further.

First of all, Jupiter–Pluto conjunction of 2020 is “well seasoned” by overlapping Saturn–Pluto conjunction, a very rare event especially given the current strength of Pluto that is at extremely close approach to the ecliptic plane with a latitude slightly under 1º. That happens only twice during 248 years of Pluto’s full orbital period.

The second strengthening factor is that it’s a “triple” Jupiter–Pluto conjunction due to both planets turning retrograde and direct thus producing not one but three moments of exact conjunction — stretched in time through a longer period of just under 11 months.

Just having these two astrological alignments is enough to make any astrologer tinkling with excitement of “Holy cow, something BIG is going to happen”.

- Began 1 Feb, 2020

- First exact 5 Apr, 2020

- Second exact 30 Jun, 2020

- Third exact 13 Nov, 2020

- Finishes 7 Jan, 2021

The severity of 2020 crisis is further amplified by “timely” arrival of coronavirus that came about at the right moment to test our over-leveraged and over-complicated economy. One may notice that the crisis unfolds itself in a well orchestrated manner, all according to the stars and planetary placements and there’s a little reason to believe that things will get back to normal soon enough.

We should expect a rebalancing action of Pluto that will take away certain amounts of wealth. It’s not going to be fair or nice as crises tend to present opportunities in an asymmetric manner: those with strong Pluto energies are likely to gain, while many others will inadvertently lose much of their possessions.

Pluto is synonymous with accumulation of riches. And we’re already witnessing how wealth attracts even more wealth. Just look at the example of Jeff Bezos and the likes. Companies that have built crisis-proof revenue streams and ground their success in future-proof technology, data, etc. — will benefit greatly. Many weaker “wishful” business models are likely to cease operating under pressure of reduced demand.

What’s next: money is Unobtanium

The third decade of the 21st century will witness a major disruption of supply lines and significant redistribution of capital. A number of things will need to be reinvented and those who can intuitively see into the future are likely to benefit the most.

One of the most significant innovations could well be a dramatic change in what money is and what money represent. Aligning money to gold worked as long as the world had just a handful of mostly self-sufficient states. Industrialisation, globalisation and capitalism demanded a shift from gold standard towards “promise” as a value. Now this breaks down as well — we have just learned that we’re not good at keeping our promises but really good at piling up mountains of debt.

The next kind of money will be based on information and technology. Personally I don’t believe that the current cryptocurrency market is the final answer. It’s the first step towards measurable and secure monetary system.

What’s missing is a great challenge to the governments that shakes them out of their preferred “business as usual” ponzi-style model of endlessly projecting debt onto future generations while retirement-age politicians and government officials continue living like it’s 100 years back in time.

Cryptocurrencies will come with a number of requirements that we all will have to get used to. The most obvious is that all money will become traceable. We won’t be able to store cash in a pot for a rainy day. We will get over that.

Both industries and societies will have to adapt to a certain scarcity that new monetary system will impose. The need for scarcity will be the lesson from tumultuous first decades of the 21st century. Systems that will embrace the necessity of financial scarcity will perform better in long term, just like a lean and slightly hungry runner always outruns a well-fed, smoking and drinking couch occupier.

There’s a healthy attitude in treating money as unobtanium and achieving more with less. In other words the “real stuff” economy should run financial markets, not vice versa.

25 Comments

Roger

All I can muster up is: “This is awesome!”

Erika

Thank you for sharing your insight. This transformation is a much needed one, and as always (though we may not see it), it is occurring with perfect timing.

Glenda

So nicely explained. Thank you!

Mark

Considering that we are in a full-blown spiritual war, the only way to fix this economic mess is to return to the gold standard. Gold represents the Alpha energies (and Christ consciousness) and silver represents the Omega energies. Since the passage of the Federal Reserve Act of 1913 we have been living under a fiat currency and economic slavery, which is worldwide. If we don’t eliminate the Fed and international central banks and their manipulations of everything, there will not be freedom anywhere. You cannot have real, true freedom without economic independence from the fallen angels.

Time Nomad

Manipulations is the keyword here. Self-inflicted lack of transparency that the governments suffer so much from. Things can be and should be simpler. It looks like deep inside most of politicians just don’t know what to do, they are lost due to complexity of the situation, so all they can do is keep patching up hoping that “it won’t happen during my term”. The curious downside of democracy is that politicians have no skin in the game, it’s nearly always win-win for them.

On the esoteric side, Gold–Silver is the Sun–Moon balance of energies, the force that holds the planet together and allows life. Live long and prosper.

JoJo Razor

Your company is definitely forward thinking. It sounds like honestly and truth will become important for us to become the new lean machines. As we turn within I would assume we will start looking at our addictive consumption life styles purging all unnecessary aspects. As I purge the time sucking and consuming apps from my devices just know your educational app will stay. Thank you for creating Time Nomad.

Time Nomad

Financial gluttony leads to obesity and then the bubble pops. History is full of this. As you say, being lean is the way forward, those will survive and thrive.

Grabmayer

Thank you for this great article. Above all, your vivid connection of historical and current relationships. But finally I had to smile at this sentence: “Yet long-term pursue of the model of unlimited growth is hardly a viable strategy here on Earth with its inherently limited resource pool”, because right now and precisely to the Jupiter / Plutoconjunction some states want to escape this earthly scarcity. The many Mars exploration missions these days are already trying to escape this earthly shortage and look for resources on the next planet.

Amy

love this post! thanks for sharing. i wonder how much of the future currencies will be connected to our “data” and how digital property rights factor in?

Time Nomad

My perception is that in the future much of our lives will be nearly entirely “documented” by digital systems that we use, there’s really no other way around that — once we do something in the digital world, we leave a trace, a record is automatically created. From this standpoint it is very likely that most of our lives will be thoroughly “logged”. We will eventually get used to that, generation after generation.

Monetary transactions will certainly have personal electronic “thumbprints” all over them: from whom, to whom, time, place, reason, etc. This could have positive effect on the overall economy as those streams can be optimised, analysed and improved. Future societies may be able to be leaner and much more stable — that’s obviously provided that governments won’t be corrupt.

There is some degree of hope that having personal cryptocurrency fully transparent may help preventing (or fighting) government corruption. Thant’s a good outcome. At the end of the day, most of crises come from natural degradation of the ruling elites. Slowing down that degradation can bring net positive outcome for the whole of society.

And taxation is guaranteed to be much much easier or even fully automatic, no time wasted doing taxes! Accountants will suffer though.

Chris Sustaire

Great interpretation. I too study astrology and am awe struck. So much deception thrown in at the same time isn’t helping the situation. (Thanks Neptune). These times are definitely a challenge. Time to tighten the purse strings. Thank you

Time Nomad

Yes, mess and deception are Neptunian side effects. Neptune can bring about massive delusions, especially when enforced by some other planets. And that’s I think the problem with America as the current dominant economic force, it doesn’t have a good grasp of Neptunian values, hence all the twists that we’re witnessing.

Catalina Merchan

Loved this article. It reminded me of the introduction to the Chaos Protocols by Gordon White

Time Nomad

Interesting that the notion of magic (that the book touches) will not disappear in the future but will move from “crows, runes and omens” to digital and numerical magic, there will be digital number crunching magic at levels we’re currently not aware of, that will produce some serious results. The 21st century is the period of transition from old atavistic type of magic to magic 2.0 so to speak — that’s truly exciting times to notice the shift and start learning new forms of magic.

From the esoteric perspective, the previous generation of beings (that were backing nature, culture, rituals, etc) on which the old classical magic rested have pretty much completed their departure from the world scene around 1970-80s, hence the current breakdown of “old” ways and methods, including much of magical lore that was with us for many a centuries.

It’s the time for new and truly exciting things to emerge.

Bárbara

Great!

Mich

Born at 19 deg Capricorn, Ive had the Pluto, Saturn, Jupiter dance right over my head since 2008. Then we lost all our money and I found myself supporting a family of 3, job to job and carrying a 70 debt. Last year, I amassed some money but without employment, it went. Lucky to.have a job now, but my take on personal money management has changed forever. I personally lived these astrological influences, to the core! Not easy.

Time Nomad

Could be your Moon playing up. Alternating financial luck often caused by the Moon positioning in the chart, the Moon is very changeable and will be finances. Watch its transits and progressions, may bring some ideas.

Mich

Thanks for responding. Thankfully the 2 yr Cancer/Capricorn eclipse series completed, so hope fully will settle down. I think Pluto was the biggie too. Im Scorpio rising as well…aaaaarrrgh.

Kurt Shaffer

A great read, thank you. While the aspects don’t change I do change the signs in my head for Sidereal. So I guess Bill Gates’ digital marker in his vaccine will be realized and every human on earth will need that in order to do a lot of things in life. Whatever, I’m not getting that.

Lauren

My group of friends and I discuss this exact thing a lot. You’re definitely not alone in your thinking. The current deception = mandatory vaccines bc of Covid but really it’s the digital marker for everything going forward. You can count me out, while everybody else thinks it’s “cool” to scan your wrist to pay for groceries.

LunarTunes

I’m here to say give crypto a chance!

Bitcoin is such a beautiful expression of many planetary energies and it was developed precisely in response to the 2008 crisis: 1) the Saturnian energy of a defined beginning and ending as it’s algorithmically limited to 21 million coins. 2) Blockchain in general is the epitome of Mercurial energy, of the efficient flow of information, the foundation of trade. Also the trickster spirit of the nouveau rich cypherpunks and crypto traders 3) the Jupiter energy of expanding good fortune through mass adoption. For many crypto is a political and philosophical movement to expand access to financial services for millions who have been excluded. If you’ve never had a bank account, you would be able to leapfrog into a crypto wallet. 4) Bitcoiners unconsciously invoke the moon with a lot of their slang, and I think there’s some Lunar power underfoot :)

I could go on! I really think this technology is a spiritual tool that is changing the world.

Time Nomad

Bitcoin-like cryptocurrencies do hold a promise indeed. They certainly are future oriented in their appeal (open standards), technology based and offer transactional transparency. Yet, it’s a very early stage for crypocurrencies and a lot of excessively optimistic people will get burn trying to get into the game. Somewhat similar to the Robinhood traders who are excessively optimistic but may lack deeper understanding of the foundations of how real economy and financial economy work. Crypto and online trading always come with a catch — too easy to push a button, hence their addictive nature. That’s something I take with extreme caution.

We shall see how cryptocurrencies unfold and who will be unavoidable losers and winners. Fundamentals like gold and silver are likely to remain fundamentals because no one can “hack” the amount of gold on the planet (that is until asteroid mining develops). Yet there’s always a risk that the blockchain integrity may get disrupted in a number of ways that we’re unaware of yet, just like we were unaware of coronavirus. This world is full of wonderful surprises, isn’t it?

Kia

Great post! New sub and I love what I’m reading so far!

Tako

A person in the ♃ △ ♇ was excited to see it. But the sun is in the Scorpio. I don’t know if I have adapted to the Aquarius era.

Time Nomad

Notice how Jupiter Pluto trine can be waxing or waning. That would add extra dimension to your relationship with the flow between those planets.